You are here

Synchronization Across Maritime Value Chains Can Ease Inflation

Synchronization Across Maritime Value Chains Can Ease Inflation

Feb 2, 2022 5:12 PM by Mikael Lind et al.* https://www.maritime-executive.com/editorials/synchronization-across-mar...

Value chain disruptions are increasingly blamed for inflationary tendencies, although there are multiple other factors that can drive consumer prices up. Since the summer of 2020, continuous challenges caused by tighter capacity of boxes, ships, port infrastructure and hinterland transport have caused far reaching impacts on supply chains and national economies. Continuous disruptions are increasing transportation and logistics costs along chains with record high ocean freight rates as one of the results. Reports indicate that value chain actors tend to “optimize” for themselves, which only exacerbates the issues at system level. This contribution addresses the need for visibility and transparency in vessel dynamics across the global shipping network to cope better with value chain disruptions. Data sharing and time slots empower different parties through more informed decisions, flexible practices and plans. The slot management concept ensures an expansion of the just-in-time (JIT) vessel arrival approach as well as enabling synchronization across the global intermodal supply chain that consist of a stakeholder network of consumers, retailers, logistics providers and hubs, carriers, producers, manufacturers etc., as well as infrastructure, equipment, resources, and processes.

The choked maritime value chain drives inflation

Today’s intermodal supply chains are increasingly ‘disjointed’ Logistics hubs. In particular ports, are insufficiently synchronized with ship journeys on the one hand and multimodal transport capacity in the hinterland on the other. Record high ocean freight rates (figure 1) and rising costs of landside transport, such as road, rail, barges, as well as airfreight moves are a clear invitation to reassess current practices in goods flow management. The historically high freight rates combined with port congestion and other surcharges, plus rising dwell time charges in ports’ have led on some trade routes to a fivefold or even tenfold increase in transportation costs compared to pre-pandemic levels, thereby contributing to rising inflation.

For a forty-foot container unit (FEU) filled with higher value products such as sport shoes or mid-priced clothing with a combined retail value of USD 1 million, ocean and port costs on the Far East-North Europe trade now represent 1.5-2% of shelf value. This used to be less than 0.3%. UNCTAD’s Review of Maritime Transport 2021[i] estimates that the high levels of freight rates have led to a 1.5% global increase in consumer prices. The Kansas City Federal Reserve Bank estimates that a 15% increase in shipping costs leads to a 0.10 percentage point increase in core inflation after one year.[ii] According to UNCTAD, Small Island Developing States are affected 5 times more strongly than the average increase, with a consumer price hike of 7.5%.

For voluminous low value products of USD 50,000 per FEU, such as low-end assembled furniture, the share of ocean and port costs in total retail value has mushroomed from 5-6% in 2019 to a hefty 30-40% now. This has pushed retailers to consider a significant upward shelf price correction. High value products are also affected, given that during the process of their production inputs are transported numerous times, and at each stage of the value chain higher transport costs add to the total production costs.

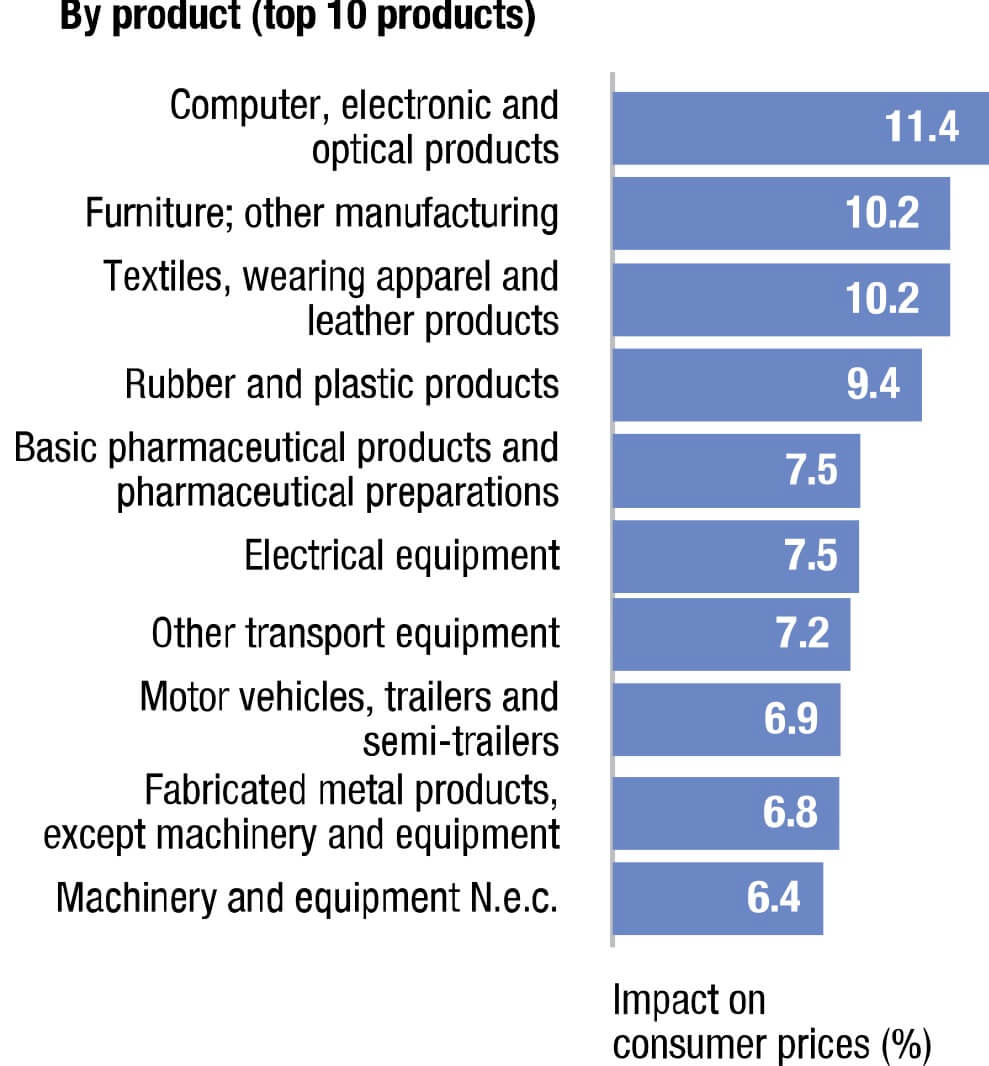

As UNCTAD’s Review of Maritime Transport shows, there are two types of products most strongly affected by the high freight rates:

Relatively low value goods, such as furniture

Products that involve a deep supply chain, with several stages where transport is purchased (Figure 2).

continue....https://www.maritime-executive.com/editorials/synchronization-across-mar...

*[By Mikael Lind, Wolfgang Lehmacher, Jan Hoffmann, Lars Jensen, Theo Notteboom, Torbjörn Rydbergh, Peter Sand, Sandra Haraldson, Rachael White, Hanane Becha and Patrik Berglund]