You are here

Liner shipping on course to smash last year’s record profits

Liner shipping on course to smash last year’s record profits

Sam Chambers August 10, 2022 https://splash247.com/liner-shipping-on-course-to-smash-last-years-recor...

Liner shipping is on course to smash last year’s record profits by as much as 73%, according to new forecasts from John McCown-led Blue Alpha Capital, citing the soaring contract rates secured by carriers in 2022 and the ongoing port congestion issues.

Net income this year will likely reach $256bn based on the 11 carriers monitored by Blue Alpha Capital, a figure Bloomberg has pointed out is roughly equivalent to the gross domestic product of Portugal. Last year, liner shipping made a record profit of $148bn, according to McCown.

McCown has raised his outlook by $36bn since an earlier April forecast after a series of better-than-expected results for the second quarter were announced, the latest of which was South Korea’s HMM today.

HMM revealed a record net profit of $4.62bn for the first half of 2022, up by 1,560% over the same period last year.

“The global supply chain is forecast to remain strained in the coming months. Port congestions in major locations are still pervasive,” HMM stated in a release.

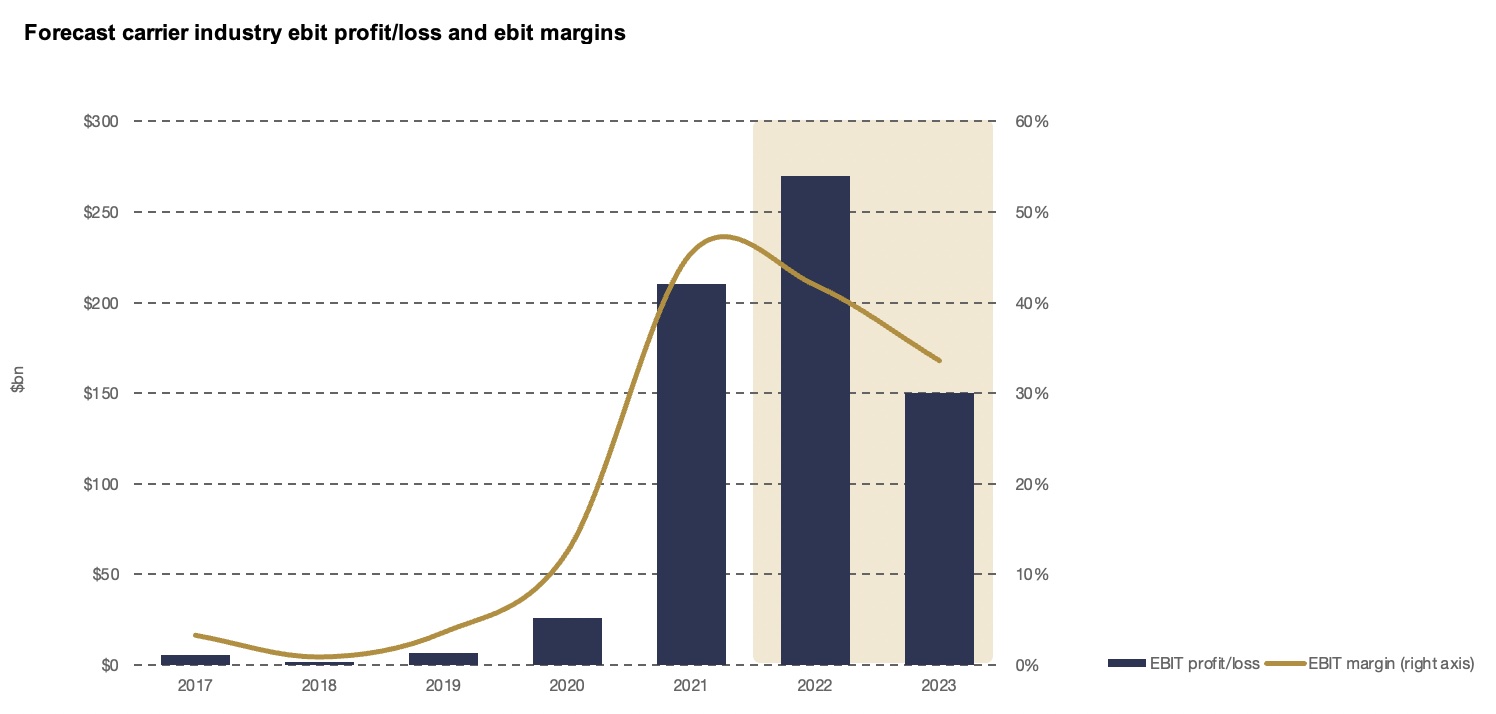

British consultancy Drewry, meanwhile, also sees a record liner profit this year, totalling a remarkable $270bn, equivalent to the GDP of Finland. Drewry then sees a dramatic drop off in profits next year, nearly halving to $150bn (see chart below).

Maersk, the world’s second largest container line, revealed earlier this month it expects to register a record profit of $31bn for the full year, while in Germany, Hapag-Lloyd is raking in so much money at present it is close to overhauling Volkswagen as the country’s most profitable company.

A recent report on container shipping prospects from HSBC suggested higher contract freight rates and persistent congestions would help cushion against weakening spot freight rates in the second half of this year.

“Demand normalisation and unwinding of congestion might take place slower than expected, which present upsides to container shipping profitability in 2H22. Going forward, we argue that after years of consolidation and formation of mega shipping alliances, the shipping lines have learnt the capacity discipline and while there might still be volatility in freight rates, the rock-bottom level of freight rates seen in the past decade might no longer persist in the future,” the report from HSBC predicted.

On the current market conditions, Judah Levine, head of research at online platform Freightos, stated today that most of the ocean freight peak season was pulled forward to spring this year.

“Combined with some decrease in demand driven by inflation and changes in consumer spending, it also looks like the shift toward normalisation has started, but will be gradual as demand remains strong and congestion continues to strain capacity,” Levine said.