You are here

2022: The year shipping made do without China

2022: The year shipping made do without China

Sam Chambers December 16, 2022 https://splash247.com/2022-the-year-shipping-made-do-without-china/

Shipping is never dull, and the moment you feel it might be is probably the time to seek a different career. Being in this industry gives those curious enough an advanced view from the bridge of geopolitical and economic forces shaping the world.

Unquestionably the biggest news story of the year – the one that reframed most other developments – has been the Russian invasion of Ukraine and the subsequent reshaping of the global seaborne energy map.

For this column, however, I’d like to focus on something perhaps a bit more subtle, but arguably more important to the fortunes of the shipowning class, namely China.

Much of 2022 for me has resembled the year 2001 when world shipping eagerly looked on, counting down the months to China joining the World Trade Organization. In the years that followed, the Chinese economy exploded and shipping made obscene profits.

The fact is that in the 21st century there has been no more important country to shipping’s fortunes – whatever the sector – than China. Its incredible pace of urbanisation, willingness to take on the factory of the world mantle, and then its growing middle class – all has created intense maritime trade to push the country to silver spot on the world economy podium. Think about this – in GDP terms the Chinese economy grew more than 14-fold from the start of the century through to last year, a scale and speed the like of which we will never witness again.

And here’s the thing, shipping has had to make do this year without the normal rocket China gives to earnings. China and its strict zero-covid policies through to this month have hampered industrial production, created enormous supply chain headaches as well as ensuring GDP growth at this giant nation will be the slowest recorded this century with the real estate market implosion being of particular note.

It’s remarkable that given this slack growth shipping has prospered. The cross-sector ClarkSea Index, a decent weighted barometer assessing the overall health of the shipping sector, now sits at $34,133 a day, more than double the 10-year trend, with the average in the year to date standing at $37,600 a day, up 32% year-on-year – this is in no small part down to the dislocation and inefficiencies brought about by war in eastern Europe.

But rather like 2001, another factor that has helped prop up earnings this year has been the strong economic growth witnessed in India and Southeast Asia. Dragons are coiled and tigers are leaping. Power plants, steel mills and factories are shooting up in the region like mushrooms, stoking new maritime trades – and while no where near to the gigantic throughput figures generated out of China these days, the growth seen in this part of the world has been one of the year’s lesser discussed but important themes.

I am nowhere near from writing off China – in fact I’d argue from Q2 next year we will witness a massive spike in dry bulk and tanker earnings as the world’s most populous nation bounces back in a big way. However, what 2022 has taught shipping is that life without double-digit growth from the People’s Republic can be manageable.

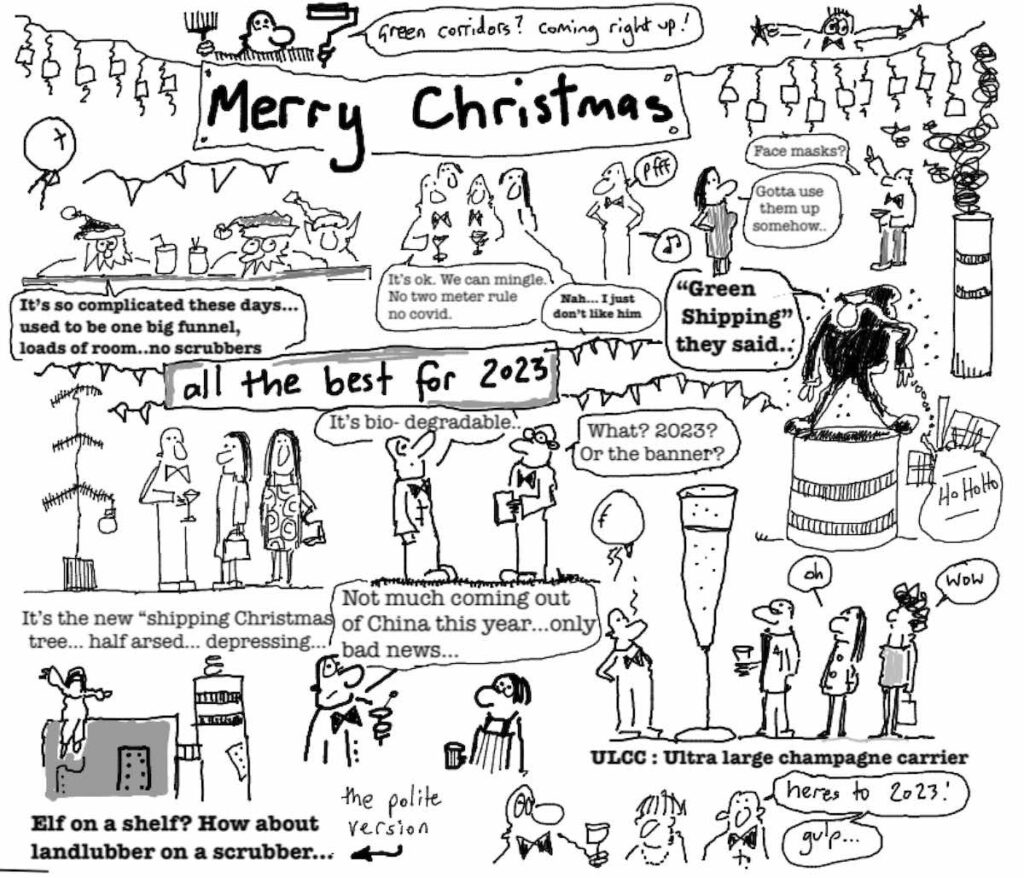

Now that’s more than enough waffling from me. We’ll be taking a breather for the next couple of weeks, so while the site will be uploaded with key stories there will be no daily newsletter. Wishing all readers a fine festive season – now for The Freaky Wave’s take.

The shipping news that shaped 2022

The Russia – Ukraine war and the reshaping of the world energy seaborne map

The European Union’s inclusion of shipping within the bloc’s emission trading scheme and the development of the FuelEU Maritime regulations.

China and its strict zero-covid policies through to this month.

The battle for control of Antwerp-based tanker giant Euronav.

Mediterranean Shipping Co’s extraordinary growth at the top of the liner rankings.

The container bubble bursting, albeit with the sector still on track for record annual combined profits in excess of $200bn.