You are here

Fear of catastrophic shipping accidents rises despite safety gains

Fear of catastrophic shipping accidents rises despite safety gains

Greg Miller June 01, 2023 https://www.freightwaves.com/news/fear-of-catastrophic-shipping-accident...

Ship losses hit record low in 2022 but ‘things could turn quickly’

The Pablo, a 26-year-old tanker engaged in the sanctioned “shadow” crude trades, exploded off the coast of Malaysia in early May, killing three crew. There are a lot of ships out there like the Pablo. Older tankers that would normally be scrapped are now earning top dollar carrying crude and diesel for Russia. By some estimates, a tenth of the global tanker fleet is now involved in shadow trades.

Meanwhile, decades-old container ships that would normally be scrapped were pressed into service during the COVID-era freight boom. Even now, after rates have normalized, older container ships remain in service. Demolitions remain minimal.

“We just can’t think of a justifiable reason for owners to persist with some of these old clunkers, other than they want to keep sweating them while they’re still making drips of money,” said Simon Heaney of container shipping consultancy Drewry in a recent presentation.

All this sounds like a recipe for catastrophic maritime disasters. And yet, incidents like the Pablo explosion have been the exception. Total ship losses fell to a record low in 2022, according to the annual safety report released Wednesday by insurance provider Allianz Global Corporate & Specialty.

To understand the juxtaposition of escalating fears over shipping safety and declining total losses, FreightWaves spoke with Rahul Khanna, global head of marine risk consulting at Allianz.

“The shipping industry has done a lot of good work over the years but things can turn quickly,” warned Khanna.

“We need to keep things under control because it’s very easy to lose this great track record we have. We have only seen a few incidents so far with the shadow tanker fleet but that number could mushroom into something much bigger.”

Total losses down 70% over past decade

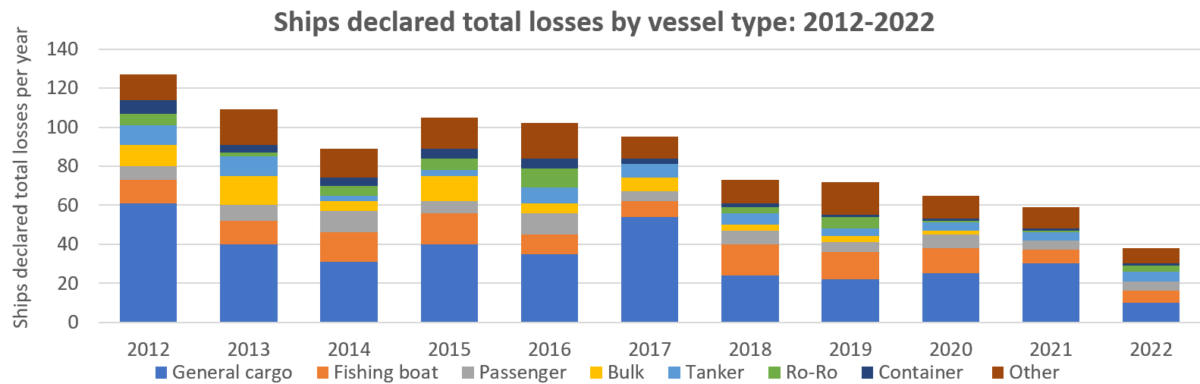

There were only 38 ships declared total losses in 2022, down 36% from 2021 and down 70% over the past decade, compared to 127 total losses in 2012, according to Allianz data.

Looking solely at cargo transport vessels — general cargo, bulk, tanker, ro-ro and container ships — total losses plunged 47% year on year and 80% since 2012.

Khanna credited new regulations and requirements; support from insurers, classification societies and other service providers; and shipowners and operators “upping their game and in many, many cases going way above and beyond what was required by the regulatory framework.”

Vessel sinkings remained the largest cause of total losses, accounting for 53% of maritime casualties last year. Fires and explosions came in second, accounting for 21%.

The trend in the total number of incidents, including minor casualties, is less flattering to the shipping industry. There were 3,032 incidents last year, slightly above the 3,000 reported in 2021. Machinery failures accounted for 49% of incidents, fires for 7%.

Are older ships less safe?

There is nothing inherently wrong with older ships. It comes down to how they were maintained during their life spans and how they are currently operated, crewed, maintained and insured.

Bob Burke, CEO of Ridgebury Tankers, has frequently defended the use of older, well-maintained tonnage when speaking at industry events. He recently noted that the average age of the tanker fleet is 12.3 years, while the average age of airplanes in the U.S. is 14 years and the average U.S. rail locomotive is 27 years old.

“Everyone thinks newer is better, but if you step on an airplane, it can be 30 years old,” Burke said. “When you buy a ticket, has anyone ever asked how old the airplane is? No. You put your kids onboard and you blow them across the ocean at 500 miles an hour and everyone seems comfortable with that.”

Many of the older ships in the container industry are operated by large ocean carriers with high safety standards.

Maersk recently sold four 8,500-twenty-foot equivalent unit container ships built in 2003 and 2004 to Global Ship Lease (NYSE: GSL), then chartered them back from GSL for a minimum of two years with a one-year option.

According to brokerage reports, MSC recently bought two 1999-built ships and CMA CGM has continued to charter ships built 20 years ago.

Khanna agreed that it’s not simply a matter of age. “As insurers we would say, yes, the ship is old but if the operator is first-class, we’re OK with it. However, there is a point where you will start to have problems no matter how much maintenance you do.”

Commenting on the older container ships, he said, “When rates were astronomical, some ships’ lives were prolonged. In some cases, they were even brought back to life. I think this takes time to translate into actual accidents and incidents. We should be thankful that the market has changed and rates have come back to pre-pandemic levels and some of these ships will be taken out of the system [scrapped] this year or probably next year.”

Rising threat from shadow tanker fleet

As with container ships, tankers are being kept in service longer due to profit potential. The crucial difference in the case of tankers is that profits are being derived from sanctioned trades, which has different implications for how vessels are currently operated, crewed, maintained and insured.

Tankers involved in the Russian export trade are not uniform. On one end of the spectrum are fly-by-night operators with no insurance using low-quality flags of convenience. On the other end are quality operators complying with the price-cap sanctions. In the middle are sanctioned players that operate well-maintained fleets and use non-Western insurance.

“When you talk about the shadow fleet, if you think about [Russian operator] Sovcomflot, the larger insurance companies were insuring its vessels for a long time before the war and the sanctions kicked in. It doesn’t mean things go drastically wrong overnight,” noted Khanna.

“There are those with ships that are still in great condition with top-quality crews and insurance, and then you have the other ones, the more unscrupulous fly-by-night operators using vessels that were going to be scrapped, using the cheapest crews and doing hardly any maintenance. There’s a combination of the two.”

The greatest safety and environmental threat lies with tankers actively evading sanctions. “Running a tanker is a high-risk operation in any case. If you’re trying to keep a low profile and hiding and spoofing GPS [putting out false location data], that creates additional risks.”

With ship-to-ship transfers commonly used by sanctions-evading tankers “you’re likely to take a lot more risks if you’re trying to hide, so the chances that things go wrong increase exponentially,” added Khanna.

There are also heightened risks for the quality operators in the Russian trade, he explained. “What worries us insurers is that there are a lot of quality companies — including service providers like insurers and classification societies and others — who pulled away because of fear of sanctions and reputational damage.

“That means that even the top-quality operators may not be able to access things like spare parts or service teams or fuel suppliers or so many of the other things that help run a ship in good condition. Safety is not just about the shipowner. It’s also about the other stakeholders around them — and the shipowners don’t have access [to some of these]. So, it’s not just the unscrupulous ones but also the decent operators that are having a problem.”

Sanctions and international regulatory regime

Strong gains in safety over the past decade have been largely credited to the global regime of safety and environment rules promulgated by the International Maritime Organization (IMO). The emergence of the shadow fleet, driven by Western sanctions, has bifurcated the fleet and inherently lowered adherence to global standards.

“Maybe the politicians that set up the current sanctions were aware this would happen and it was an acceptable collateral damage … but there is a lot of murky stuff going on,” said Svein Moxnes Harfjeld, CEO of crude-tanker owner DHT (NYSE: DHT), during a quarterly call earlier this year.

“The insurance industry definitely has concerns about this whole development,” said Khanna, regarding the sanctions effect. “But this is something that is way beyond the insurance industry’s control. This is more political. It is not a creation of the industry and not a problem we can solve. The best we can do is to keep watching what’s happening and keep making preparations.

“We can congratulate ourselves on this great safety record but we have clouds on the horizon. Looking at total losses is just one metric. Another is looking at trends and risks and how they could develop and how severe they could. And I fully agree that this [political issue] could morph into something that might destabilize or even have a larger impact on the safety record of the shipping industry overall.”