You are here

‘Challenging times ahead’: Maersk lets go of thousands of staff

‘Challenging times ahead’: Maersk lets go of thousands of staff

Sam Chambers November 3, 2023 https://splash247.com/challenging-times-ahead-maersk-lets-go-of-thousand...

A year is a long time in liner shipping. At the end of 2022, carriers were handing out mega bonuses, some equivalent to more than a year’s pay. Fast forward to today and those same staff face the axe as the sector battles plummeting rates and rampant overcapacity.

Maersk today issued its Q3 results, detailing how it was accelerating staff redundancies whereby the Danish transport giant’s global workforce will number less than 100,000 by the end of this year, having started out 2023 with around 110,000 men and women on its books.

Conceding it faced a “difficult market environment” with rates well off their 2022 peak and tested by the increase of boxship capacity, Maersk’s Ocean division suffered red ink for the first time in many years, posting an EBIT of $-27m for Q3, a far cry from the $8.7bn the division recorded in the same quarter last year.

“Our industry is facing a new normal with subdued demand, prices back in line with historical levels and inflationary pressure on our cost base. Since the summer, we have seen overcapacity across most regions triggering price drops and no noticeable uptick in ship recycling or idling. Given the challenging times ahead, we accelerated several cost and cash containment measures to safeguard our financial performance,” said Vincent Clerc, the CEO of Maersk.

Maersk said today it now sees global container volume growth in the range of -2% to -0.5% compared to -4% to -1% previously.

All liners are faced with the same troubling market dynamics – reduced demand at a time of unprecedented ship deliveries.

With nearly a container newbuilding scheduled to deliver daily for the rest of the year, brokers Braemar have warned recently it remains difficult to anticipate where the demand should be coming from to overcome the current supply situation.

Data from Clarksons Research shows there are 902 containerships on order, an all-time high, equivalent to 25% of the extant fleet.

Historically, the world container fleet grew by approximately 1m teu per year over the past decade. Full-year deliveries in 2023, however, are set to reach 2.2m teu, which will also be a new annual delivery record, beating the previous high of 1.7m teu delivered in 2015. More than 200,000 teu of newbuilds hit the oceans last month alone.

This new high mark for boxship deliveries will be immediately broken in 2024 when a further 391 ships of almost 3m teu capacity is forecast by Alphaliner to enter service.

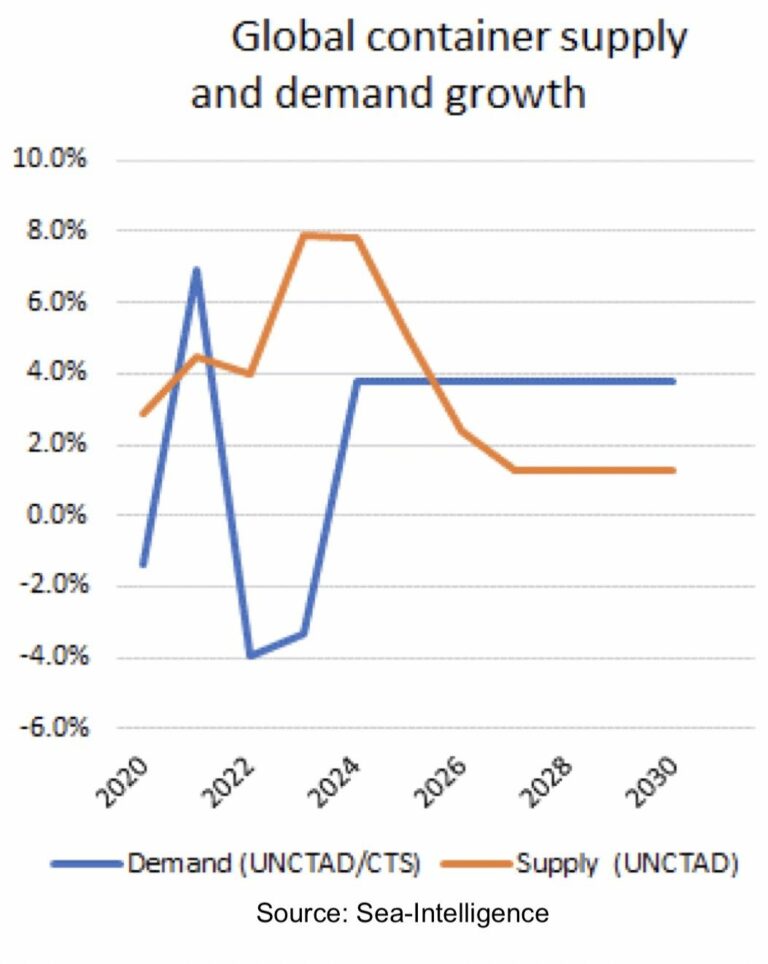

Container carriers are forecast to report a combined loss of $15bn in 2024, according to the latest Container Market Annual Review and Forecast from UK consultants Drewry. Drewry predicts it will not be until 2026 that fleet and demand growth will be in sync.

Analysts at Sea-Intelligence, meanwhile, have suggested that 2026 is too optimistic. The year 2028 is the earliest for overcapacity absorption of all the new capacity flowing out of yards in Asia, according to analysis from Sea-Intelligence, which is in line with the play-out after the global financial crisis.

“Blanked sailings are the short-term answer, with lines cutting ships from loops wherever they can. But it seems inevitable that lay-ups and period charter negotiations will be the next tactics as the liner industry seeks to absorb so many new ships, as scrapping older tonnage cannot offset the behemoths being delivered,” stated the most recent container markets report carried in sister title, Splash Extra.