You are here

New bills seek to reignite Philippine shipbuilding, bring maritime jobs home

New bills seek to reignite Philippine shipbuilding, bring maritime jobs home

Liz Lagniton July 31, 2025 https://maritimefairtrade.org/new-bills-seek-to-reignite-philippine-ship...

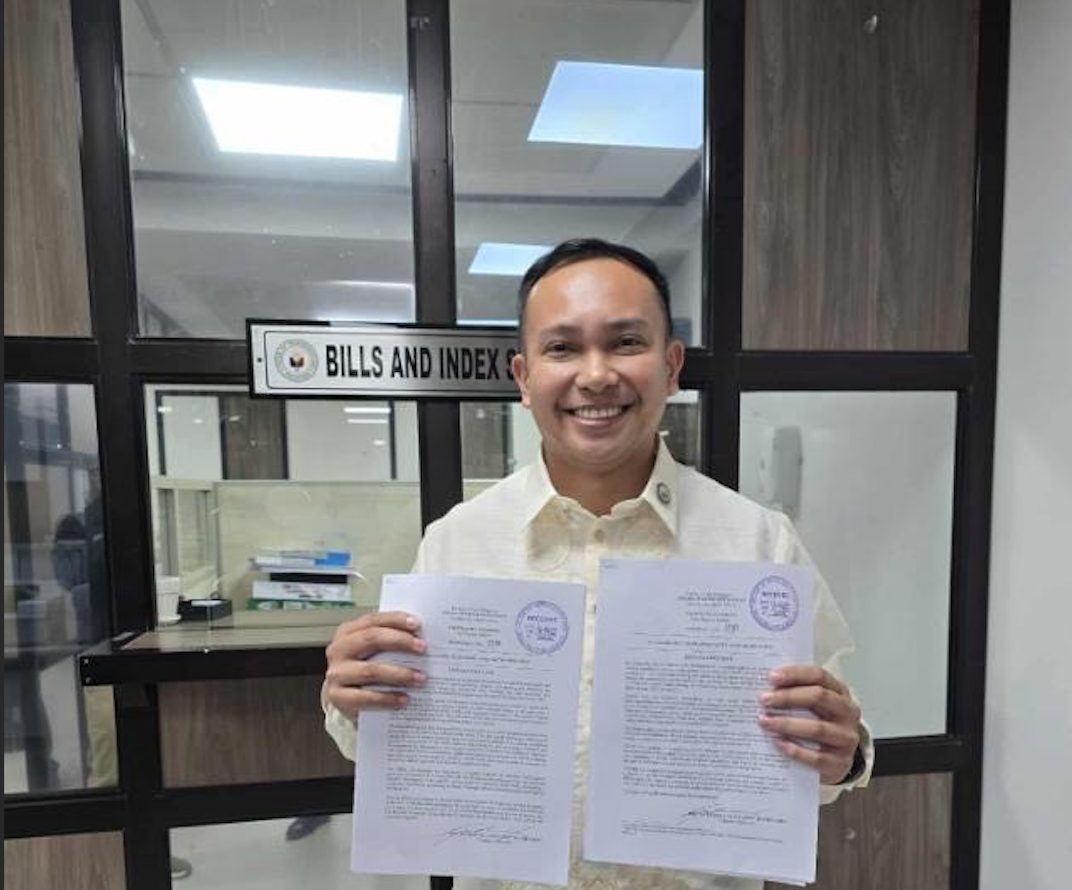

Representative Nathaniel Oducado on July 30, 2025 holds two key bills aimed at strengthening the Philippines’ shipbuilding and ship repair industry, seeking to boost maritime capabilities and generate local employment.

Two new legislative measures aimed at revitalizing the Philippine shipbuilding and ship repair (SBSR) industry were filed in the House of Representatives this week, offering renewed hope for the country’s maritime workforce and a bold vision to reassert the nation’s global standing in the shipbuilding sector.

House Bills No. 2597 and 2598, both authored by 1Tahanan Party-list Representative Nathaniel Oducado, were officially filed on July 30.

The measures are intended to draw strategic investments into shipyards, create high-quality maritime jobs, and promote sustainable industry growth through targeted incentives and reinforced institutional mandates.

“It’s time to bring maritime jobs home for the sake of our maritime workers and our overall economy,” said Oducado, underscoring the urgent need to reduce the country’s dependence on overseas maritime labor and to build capacity onshore.

The proposed legislation — HB 2597 or the Shipyard Industry Fiscal Incentives Bill, and HB 2598 or the SBSR Development Bill — comes at a crucial juncture.

Despite being the fourth-largest shipbuilding nation globally, the Philippines continues to underutilize its full potential due to underinvestment, inadequate policy support, and the aftershocks of high-profile bankruptcies, including the collapse of South Korea’s Hanjin Heavy Industries in 2019.

Twin approach to maritime revitalization

At the heart of HB 2597 is a push to reshape fiscal policy to attract and retain investors in the SBSR sector. The bill outlines a suite of financial incentives, including exemptions from value-added tax and duties on imported capital equipment and materials essential for shipyard operations.

It also proposes tax credits for capital investments and rewards for green and environmentally friendly projects, an important nod to the global shift toward sustainability.

Meanwhile, HB 2598 seeks to embed long-term support for the SBSR industry within the institutional framework of several key government agencies.

Under the bill, the Department of Trade and Industry, the Department of Science and Technology, the Department of Labor and Employment, and the Technical Education and Skills Development Authority would be mandated to implement programs focused on research and development, vocational training, and capacity building.

“Through these bills, we will create jobs in upskilled shipbuilding labor, support services, vocational training, supply chains, and coastal community development industries,” said Oducado.

He stressed the job-generating potential of the SBSR sector, citing World Bank estimates that each shipbuilding job can create three to five more in related industries. He projected that the two bills could generate up to 100,000 new jobs, both directly and indirectly.

With over 578,000 Filipino seafarers currently deployed worldwide, the Philippines remains one of the top sources of maritime labor globally. But many of these highly skilled workers are employed abroad due to limited domestic opportunities. Oducado hopes to change that narrative.

“With over 578,000 Filipino seafarers deployed worldwide, the Philippines has the potential to lead not just in seafaring, but in the maritime industry as a whole,” he said.

Policy support from MARINA

The bills have received strong endorsements from the Maritime Industry Authority (MARINA), the lead agency tasked with overseeing and regulating the country’s maritime affairs.

“These bills send a positive signal to both local and international shipbuilders that the Philippines is ready to be a leading destination for SBSR,” said MARINA’s administrator Sonia Malaluan.

MARINA’s domestic shipping service director Luisito delos Santos echoed this sentiment, highlighting the broader economic impact of a well-developed shipbuilding industry.

“A developed SBSR industry will create a positive ripple effect, bolstering the domestic shipping sector’s capacity to support agriculture, manufacturing, national defense and inter-island trade,” said delos Santos.

“It will also enhance disaster resilience and national food and supply chain security,” he added.

In June, Delos Santos told reporters that MARINA is lobbying for both the SBSR Development Bill and the Philippine Ship Registry Bill to be part of the 20th Congress’ priority legislative agenda.

These initiatives, he said, are critical to supporting fleet expansion and laying the groundwork for long-term maritime growth.

Oducado’s social media post, made shortly after the bills were filed, framed the legislation as a long-overdue intervention for a maritime nation that has historically underutilized its geographical and human capital advantages.

“With the help of this resolution, we hope to promote more efficient, humane, and modern services for our fellow Filipinos in the industry,” he said.

Strategic industry in recovery

The Philippines has long enjoyed strategic advantages in the maritime sector. Its archipelagic geography, deep natural harbors, and abundant skilled labor make it an ideal hub for shipbuilding and maritime logistics.

According to data from the United Nations Conference on Trade and Development, the country is among the world’s top suppliers of maritime manpower, with Filipino seafarers accounting for a significant share of global crews.

However, the collapse of Hanjin Heavy Industries and Construction Philippines in 2019, then the largest foreign investment in the country’s shipbuilding sector, sent shockwaves through the industry. Over 3,000 workers lost their jobs, and the 300-hectare Subic Bay shipyard was left idle for months.

That trajectory appears to be changing, with new investments and government-backed initiatives aimed at reviving the sector.

One such investment comes from Cerberus Capital Management, a U.S.-based alternative investment firm that announced last week it would invest an additional P15 billion (approximately US$250 million) in the Philippines over the next 12 months.

Cerberus acquired the former Hanjin shipyard, now rebranded as the Agila Subic Shipyard, in 2022 for $300 million.

The sprawling facility, once the largest shipbuilding complex in Southeast Asia, is now home to a variety of tenants including global shipbuilder HD Hyundai Heavy Industries, subsea cable manufacturer SubCom, logistics company V2X, and the Philippine Navy.

Cerberus’ announcement followed a high-level meeting in Washington, D.C., between Philippine President Ferdinand Marcos Jr and U.S. President Donald Trump.

During the meeting, Cerberus shared its expansion plans, which include further shipyard upgrades and new projects in logistics, energy, and transportation infrastructure.

“We believe the Philippines holds significant long-term potential as a regional hub for industrial and logistics activity,” said Alexander Benard, Cerberus’ managing director.

“We look forward to building on this momentum and supporting the development of our key strategic assets in the Philippines,” he said.

Significantly, HD Hyundai is now set to begin shipbuilding operations at the Agila facility in the fourth quarter of 2025, ahead of its original 2026 schedule. This acceleration is being viewed as a direct result of stable government backing and legislative momentum.

Special Assistant to the President for Investment and Economic Affairs Frederick Go, who accompanied Marcos to Washington, said Cerberus’ projects will serve as economic catalysts.

“These projects are vital to improving our country’s energy resilience and logistics infrastructure,” Go said adding that “they will create thousands of jobs, open new avenues for regional growth, and position the Philippines as a key logistics hub in Southeast Asia.”