You are here

IMO 2020 Full Sail Ahead: Incoming Waves for Refiners, Shipowners

IMO 2020 Full Sail Ahead: Incoming Waves for Refiners, Shipowners

13/03/2019

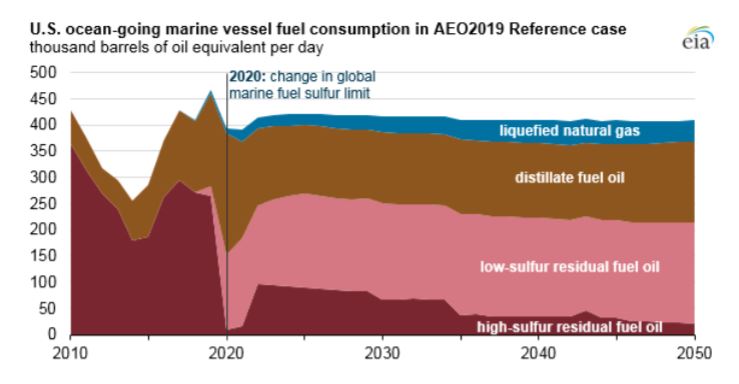

As of January 1, 2020, the International Maritime Organization (IMO) will begin enforcing a new regulation that caps the allowable sulfur content of all marine fuels from its current level of 3.5% m/m (mass/mass) to 0.5% m/m. While this new limit will not change the lower limits in existing sulfur Emission Control Areas (ECAs), it will inevitably have wide-ranging implications on oil refiners and the shipping industry, as well as force significant changes in the demands for certain bunker fuels. As a result, demand for the widely used 3.5% m/m high-sulfur fuel oil (HSFO) is expected to drop as shipowners seek alternatives to power their vessels. There has been global debate about IMO 2020 being delayed or phased in but as of now there has been no indication of any delay in the scheduled implementation. As if to underscore their position, in October 2018, the IMO adopted an additional ban on ships even carrying high-sulfur marine fuels starting in March of 2020 unless they have the required equipment on board to use them.

Globally, marine vessels account for about 4% of global oil demand and are a critical part of the global economy, moving more than 80% of global trade by volume and more than 70% by value.

IMO 2020 Compliance Options

Currently, there are three main ways the shipping industry can comply with the more stringent IMO sulfur specification. They include:

• Installing scrubbers that remove sulfur oxides and other pollutants from ships’ exhaust so they can continue using HSFO. Scrubber equipment can cost millions of dollars. Nearly 2,000 vessels have already installed scrubber systems, according to Norwegian consultancy DNV GL, with 4,000 more expected to be outfitted with scrubbers by 2020. According to the UN body Conference on Trade and Development (UNCTAD), there are over 94,000 vessels in the world, so 4,000 only represents 4.3% of the vessels.

• Switching to use lower-sulfur residual fuel oil or blending with distillate fuel oil to achieve lower-sulfur fuel mixes. This solution is not without its complications as the vessels will need to test the different blends in advance to ensure compatibility and that there is no damage to the equipment.

• Switching from petroleum-based fuels to other fuels such as LNG (this option is likely constrained to new builds since it involves retrofitting costs). Other alternative fuels are also under consideration, including the use of methanol, LPG, compressed natural gas (CNG), biofuels, solar power or fuel cells. Globally, there has been an increase in the sale of LNG as a marine fuel as the sales of heavy fuel have declined. Wood Mackenzie anticipates that the use of LNG in shipping will increase 70% between 2019 and 2020. Several of the super-majors are investigating the market for LNG as a bunker fuel which would help offset the current supply constraint on the LNG side.

more...https://www.hellenicshippingnews.com/imo-2020-full-sail-ahead-incoming-w...