You are here

Chinese Oil Tankers Are Being Booked Again, But Surging Prices Will Stay High

Chinese Oil Tankers Are Being Booked Again, But Surging Prices Will Stay High

Alaric Nightingale and Serene Cheong October 9, 2019 https://www.bloomberg.com/news/articles/2019-10-09/cosco-oil-tankers-bei...

After a two-week hiatus, oil traders are once again booking supertankers operated by a Chinese shipping giant that got caught up in U.S. sanctions.

The charters probably won’t immediately calm a tanker market that’s soaring daily to new heights.

Two 2 million-barrel carrying tankers -- the Xin Lian Yang and Xin Yue Yang -- have been provisionally booked by unidentified companies, according to four shipbrokers involved in the market.

The U.S. sanctions were on two subsidiaries of China COSCO Shipping Corp., the biggest merchant vessel owner in the world. The measures prompted traders to cancel charters linked to COSCO even though the parent company itself wasn’t implicated. The trouble is, shipbrokers report that there’s still a lack of clarity about which tankers are subject to the actions, and which aren’t. Two bookings don’t alter that.

That matters because the overall COSCO fleet comprises 43 very large crude carriers -- roughly 86 million barrels of transportation capacity -- as well as multiple smaller tankers, according to data from Clarkson Research Services Ltd.

So until such time as there’s clarity about which ships are sanctioned, shipbrokers say vessel availability will probably remain constrained. And even once there is clarity, the market might yet find fleet supply limited if it turned out that a large number of COSCO’s tankers have been affected.

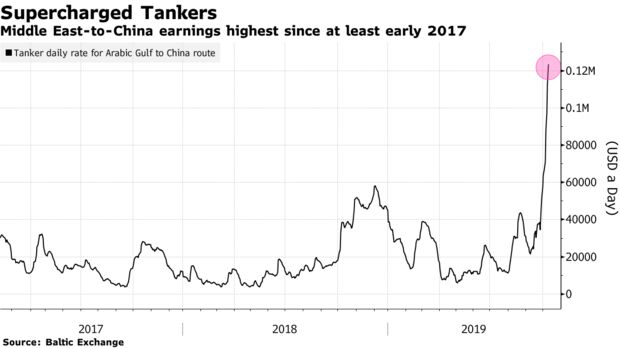

Tanker rates had already risen last month following attacks on Saudi oil installations when traders quickly moved to source crude from regions outside the Persian Gulf, thereby curbing vessel supply. On top of that, some ships are being fitted with scrubbing equipment to eliminate sulfur emissions in preparation for tighter rules on vessel fuels that are scheduled to take effect next year.

High shipping costs usually start to take their toll on the oil industry eventually, with the fall-out from the sanctions already evident across the market. Refining margins in Asia are being diminished, historic arbitrages have been eroded and crude exporters may find they have to cut prices to shift their barrels.

It’s not normally sustainable or profitable for traders and oil refineries to pay huge lump sums like $14 million -- or $7 for each barrel -- to move oil across oceans, as some are currently doing. The question is what the new normal is going to be when the situation with COSCO’s fleet becomes clearer.