You are here

Falling Global Trade-To-GDP Ratio Worries Shipping Industry

Falling Global Trade-To-GDP Ratio Worries Shipping Industry

31/12/2019 https://www.hellenicshippingnews.com/falling-global-trade-to-gdp-ratio-w...

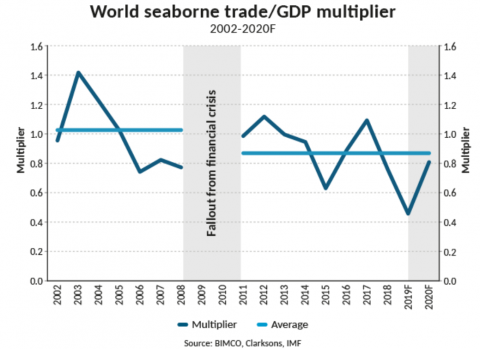

The global trade-to-GDP ratio has fallen since the 2007-2008 global financial crisis and will affect shipping demand in the years to come, says Peter Sand, chief shipping analyst for the shipping trade organization BIMCO. He calls it “one of the most worrying trends for the global shipping industry.”

“The falling ratio can be explained by slowing globalization as well as increasing protectionist measures being implemented around the world, spearheaded by the U.S.,” Sand wrote in an article posted on the BIMCO website. “The raised barriers to trade are here to stay as we enter a new decade, with the shipping industry stuck with the consequences.”

BIMCO says the global trade-to-GDP ratio has fallen since the 2007-2008 global financial crisis.

Despite the Phase 1 deal the United States and China struck in December, Sand says, “the most difficult issues have yet to be addressed, and BIMCO therefore expects the trade war to continue to plague shipping between the U.S. and China in 2020.

“Unfortunately, they are not the only countries engaging in tariff wars. The EU also faces additional tariffs from the U.S. and we see trade tensions between Japan and South Korea,” he added.

BIMCO says that with the worsening balance between the supply of ships and demand for transport it will be difficult for shipowners to pass on the additional costs associated with complying with with the new International Maritime Organization requirement that ships use low-sulfur fuel if they are not equipped with an exhaust scrubber.

Sand offered these observations on the major segments of the shipping industry:

In container shipping,”the trade war, as it currently stands, will continue to drag trade volumes as well as freight rates down,” though he said “the trade multiplier could — in theory — return to healthier levels, bringing good news to shipping, if protectionist measures are rolled back and free trade is once again allowed to develop at its natural pace.”

He noted the global container fleet has grown by 3.7% in the first nine months of 2019, while transport demand has grown only 1%, so the “supply and demand situation is clearly set to be way off-balance.”

And with many ultra large containerships being delivered for use into the Asia-Europe trade, “smaller” ships — some with capacity of 10,000 TEU — will cascade into other trades “where there is no appetite for them, adding further pressure to freight rates and bottom lines.”

In dry bulk shipping, he said high fleet growth of 4.1% in 2019 “will play out into 2020 when the fleet is also expected to grow by more than demand,” putting pressure on freight rates.

The biggest concern for “Capesize” (100,000-180,000 dwt) shipping in 2020 is the trend in China where iron ore imports peaked in 2017 and may fall for a third year in a row.

“The structural change in China’s steel production, towards using scrap steel in favor of imported iron ore, means that Chinese demand for iron ore can no longer be counted on to increase,” Sand said.

Another piece of bad news for dry bulk shipowners is the cull in China’s pig industry because of African swine fever. The New York Times reported on Dec. 17 that Rabobank believes China’s pig herd, which used to number 440 million head, has been halved. Sand says pigs consumed most of China’s soybean imports and that “It will take years for the Chinese pig population to return to the same size as before the cull, and even then, lowering the soya content in pig’s feed will have lasting consequences.”

In the tanker industry, crude oil tankers saw rates reach record levels as a result of geopolitical events, Sand said, but he said in 2020, “after the seasonal boost fades away in the first quarter, the high freight rates in the VLCC-market are likely to disappear, as the market fundamentals have in fact worsened in 2019, with an eight year high fleet growth of 6.3%.”

In the oil product tanker market, many owners aim to “benefit from the IMO 2020 Sulphur Cap and the boost that BIMCO expects it will bring to the oil product tanker shipping industry,” Sand said. The boost comes from new trades for the transport of low-sulfur fuel from the refineries to the bunkering ports.

Sand said the sulfur cap will boost will improve tanker earnings in the first 3-6 months of 2020, but once the short term boost fades away, “the challenge facing the market is that the new ships will still be around, and will instead be fighting for cargoes in an already over-supplied make.”

The fact that the U.S. is becoming a net exporter of crude oil, he added, “is good news for the tanker industry as this involves longer sailing distances to the Far East, where the major importers are, compared to exports from the Middle East.”

Source: Freight Waves