You are here

Seafarers Heading Home Pose Next Risk to China’s Ship Traffic

Seafarers Heading Home Pose Next Risk to China’s Ship Traffic

Ann Koh 11 December 2021 https://www.bloomberg.com/news/articles/2021-12-10/seafarers-heading-hom...

Chinese seafarers weary of the pandemic are returning home to celebrate the Spring Festival early next year, adding to a shortage of truckers and port workers in the country that’s compounding snarls in global supply chains.

Some of the world’s major shipping lines including Ocean Network Express and Hapag-Lloyd AG have stopped taking new bookings for container shipments to South China’s smaller ports, a decision prompted by a lack of feeder ships to haul the boxes amid a labor crunch, according to advisories sent to customers.

Getting goods from factories in China to consumers around the world relies on an intricate network of coastal feeder vessels run by independent operators to haul containers off and on bigger ships at main Chinese ports like Hong Kong and Shanghai. River barges and trucks also connect inland cities.

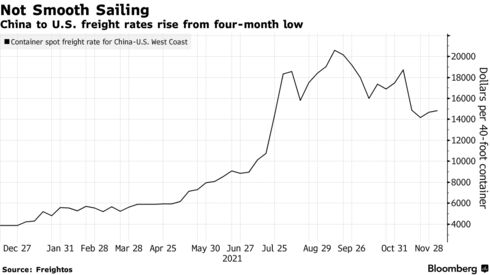

The suspension of feeder services in the Pearl River Delta and Hong Kong area for the Spring Festival, or Lunar New Year, typically lasts six weeks but is expected to stretch at least two months this time due to lengthy quarantine requirements for seafarers, according to shipping experts. That’s raising freight costs to ship a container out of South China to Southeast Asia by 30% from a week earlier, and could mean further delays at already backlogged U.S. ports, they said.

The journey home this year for Chinese seafarers is taking longer because of quarantine restrictions on travel that locals have nicknamed the arithmetic formula “14 + 7.” The country’s rules include a minimum 14-day hotel quarantine when they leave ships, followed by seven days of home confinement, Hapag-Lloyd said in an e-mail.

Anxiety over more viral outbreaks is prompting local authorities to implement additional restrictions to travel from port cities to Beijing or provinces further inland, the experts said.

The disruptions underscore the impact that China continues to have on global supply chains as the country presses on with its zero-Covid-19 strategy. From closures of Yantian and Ningbo port earlier this year to exhausted Chinese seafarers joining the world’s biggest human migration for the Spring Festival, these measures are adding to congestion at ports from Vancouver and Europe.

“If the clampdowns on cities goes on as authorities discover more new Covid-19 cases in East China, the situation could deteriorate from here,” said Salmon Aidan Lee, head of polyesters at Wood Mackenzie.

The Eastern Chinese city of Ningbo imposed a lockdown on Zhenhai district this week after discovering a case of Covid-19 and two asymptomatic infections. Petrochemicals factories have been ordered to reduce output and the movement of all workers living in the locality have been barred, according to local media reports.

While the lockdown in Zhenhai hasn’t impacted South China shipment schedules, the situation could change if authorities change rules on quarantine requirements or restrict travel, said Tim Seifert, a spokesman for Hapag-Lloyd in an e-mail. “In such cases, cross-city travel within China could be banned or require additional quarantine at the location of seafarer joining if announced by the authorities.”